which one better Credit Cards Vs Credit Union ? well, the answer would be vary! because it will depend on many factor! such what you need, what you want, limit, accessibility, Prestige's, Brand, Rates, and etc! but if you only focus on interest rates, then Credit union is your best option to get low APR! because most credit Union can give low APR than any bank can give! For example, most credit cards company for the second tier such as wall mart, Best buy, amazon, ebay, helzberg or something like that! their best APR are about 23%! either for purchases, or cash advances! but most of the time, you can't get cash advances! simply because their credit cards, are design to make purchases, not get get money from them! 😎

But lets talk about the top tier Credit cards, such Citi, Discover, Amex, Bank Americard, Chase sapphire, and etc! their best APR (annual Percentages Rates) are about 14%! for purchase, and for cash advances are about 23%! the only different between department credit cards company or second tier, with top tier are their APR purchases same with cash advances i.e 23%, but for top tier credit cards, you can get better APR about 14%, so I am not surprised if mos people will prefer with top credit cards company! simply because their APR are better than second tier can give!

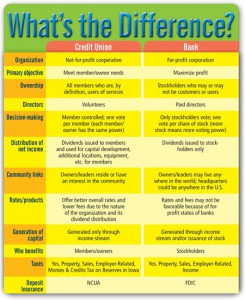

But if we compare Top credit cards APR, with Credit union, the different are almost a half! i.e 10% APR, for several cases, you can get 5% APR! yep, very far from bank can credit union! there reason why this happen! and why credit union can give lower APR than bank ? well, the reason simply because credit union are non profit Org! but they not charity! so basically what credit union do actually, they make business with free tax! yep, they don't pay tax, they don't share profit to stake holder and etc! and as result, APR Credit cards from credit union are much more better than any banks, can give! unless 1 Bank for sure 😁 but if we talk over all about APR credit cards company VS credit union, credit union are much better than any banks can give!

But in reality, many people will prefer credit cards with big bank or such as! and if we asking why the reason they not choose credit union! well, the answer are, many people need credit cards with good brands, good ads and etc! but it doesn't mean they don't know about credit union! and also credit union basically are not for everyone! because most of credit union actually only for certain people or group, or sometime, they only for people that have certain profession such as lawyers, doctor, Fireman, Navy, and etc! but at this time, Credit union are about to change to make that restriction are become less obstacle especially for people that needing credit! just for example, NFCU, at first they only for navy or DOD family that work with, but now, they make some exception, by making join owner account available! so even if you don't work in military still, you can use NFCU, product!

Credit cards with low APR are for sure big help for millions people out there! but at this moment credit union are the best option to get low APR! though the reality many people will choose bank, than credit union! so what's the deal ? In real life, sometime what want will not always come true! but it doesn't mean it's best for us! it could be we lack of information, or have restriction! but if you asking does Credit union are better than banks, or any commercial credit cards company! then my answer is, yes, credit union can give low APR for any loans product! but if you want wider accessibility and prestige's then bank would be the best answer!

But if we compare Top credit cards APR, with Credit union, the different are almost a half! i.e 10% APR, for several cases, you can get 5% APR! yep, very far from bank can credit union! there reason why this happen! and why credit union can give lower APR than bank ? well, the reason simply because credit union are non profit Org! but they not charity! so basically what credit union do actually, they make business with free tax! yep, they don't pay tax, they don't share profit to stake holder and etc! and as result, APR Credit cards from credit union are much more better than any banks, can give! unless 1 Bank for sure 😁 but if we talk over all about APR credit cards company VS credit union, credit union are much better than any banks can give!

But in reality, many people will prefer credit cards with big bank or such as! and if we asking why the reason they not choose credit union! well, the answer are, many people need credit cards with good brands, good ads and etc! but it doesn't mean they don't know about credit union! and also credit union basically are not for everyone! because most of credit union actually only for certain people or group, or sometime, they only for people that have certain profession such as lawyers, doctor, Fireman, Navy, and etc! but at this time, Credit union are about to change to make that restriction are become less obstacle especially for people that needing credit! just for example, NFCU, at first they only for navy or DOD family that work with, but now, they make some exception, by making join owner account available! so even if you don't work in military still, you can use NFCU, product!

Credit cards with low APR are for sure big help for millions people out there! but at this moment credit union are the best option to get low APR! though the reality many people will choose bank, than credit union! so what's the deal ? In real life, sometime what want will not always come true! but it doesn't mean it's best for us! it could be we lack of information, or have restriction! but if you asking does Credit union are better than banks, or any commercial credit cards company! then my answer is, yes, credit union can give low APR for any loans product! but if you want wider accessibility and prestige's then bank would be the best answer!

Tidak ada komentar:

Posting Komentar