If we talk about Credit Union, I am sure most people already know about it! in fact most credit union are already in front of you! though not many people will choose them over the Banks! 😎 Why ? not so sure the reason, and less than a half of American choose credit union! the rest they prefer with Banks!

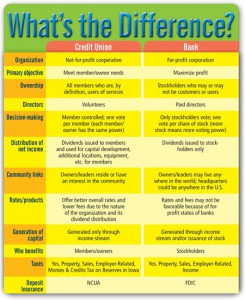

To be honest, it's nothing wrong choosing Banks, rather than credit union! even though, you must realize that most credit union, actually can give better rates, if we talk about Credit product! e.g Auto loans, Mortgages loan, Home Loans, Student Loans, Personal loan Credit cards and etc! Meanwhile Banks, can give you better rates, since they have to share and pay tax to Government! that's why Bank will never lowering their rates! at least if you don't have real value, banks will not decrease their rates! but of course if you talk to them nicely, and make negotiation, you could decrease your current APR with them!

in short Credit Union APR APY or interest rest or much more better than banks can give! but of course, it doesn't mean Credit union don't have weakness or restriction especially since most credit union are not for profit! the only weakness that credit union have are, they only for people that live near them, and some credit union only for certain group, Profession, and etc! and because of this reason many people failed to become their member! though some credit union can make exception, especially if you have good credit score! afterall, who doesn't want costumer that have good credit ? 😎

in short Credit Union APR APY or interest rest or much more better than banks can give! but of course, it doesn't mean Credit union don't have weakness or restriction especially since most credit union are not for profit! the only weakness that credit union have are, they only for people that live near them, and some credit union only for certain group, Profession, and etc! and because of this reason many people failed to become their member! though some credit union can make exception, especially if you have good credit score! afterall, who doesn't want costumer that have good credit ? 😎

If we compare between Bank and credit union basically these 2 financial institution actually are quite different! because first of all, doesn't mean bank sell Credit cards, or any credit product! because most of Banks, usually only sell banks product such as, saving deposits, Money transfer, Current account, Check and etc! but if pay attention with Loan products, such as, Personal loan, Credit cards, Mortgages loan, auto loans, home loan and etc! actually they have different division or company! though most of credit product using Bank Big brand to make easy to sell their product!

But if we talk about Credit Union, for sure, most of their product are about credit or loans! because from their names, they already stated, that they are Credit union! that's why most Credit union provide Credit and loans! e.g Student loans, Home loans, auto loans, mortgages loans, credit cards and etc! but for saving , for sure, you can't freely doing transfer with Credit union! and also there are restriction for people to transfer more than 7 times! But I am not surprised if The Fed, giving that kind of rules! cause if not, Credit Union can compete with banks! 😎 lol!

In short Credit union are Good For Credit or loans! but for banking activity such as saving, Deposit, Bank are the best place!